IFPI 2014数字音乐报告

2014-03-19 24797

(2014年3月18日全球同步发行)

音乐订阅收入推动绝大多数主要市场实现收入增长

- Subscription services’ revenues up 51 per cent in 2013, helping global digital revenues grow by 4.3 per cent

- Europe sees growth for the first time in 12 years. Revenues stable in the US and up in Latin America.

- Sharp drop in Japan sees overall global industry revenues decline by 3.9 per cent

- Global revenue excluding Japan fell by 0.1 per cent

- IFPI Digital Music Report highlights growth potential of emerging markets

- 由于订阅服务收入2013年增长了51%,全球的数字收入增长4.3%

- 欧洲市场在12年后首次恢复了增长。美国市场收入继续趋稳,拉丁美洲收入有所增长

- 如果把日本数据包括在内,音乐行业的全球收入下降了3.9%

- 如果剔除日本的数据,全球收入仅下降了0.1%

- IFPI数字音乐报告突出了新兴市场的增长潜力

Music fans’ growing appetite for subscription and streaming services helped drive trade revenue growth in most major music markets in 2013, with overall digital revenues growing 4.3 per cent and Europe’s music market expanding for the first time in more than a decade.

音乐迷们对订阅服务和流媒体服务日益增长的需求,推动2013年绝大多数主要音乐市场的贸易收入实现增长:数字收入增长了4.3%,欧洲市场在12年后首次恢复了增长。

The US recorded music market continues to stabilise, growing by 0.8 per cent in trade revenue terms with strong demand for streaming services. Europe has returned to growth after 12 years, with all top five markets – France, Germany, Italy, Netherlands and the UK – seeing an increase in revenues. Latin America saw a 1.4 per cent growth, with strong digital revenues helping offset declining physical sales.

美国音乐市场继续趋稳,贸易收入增长了0.8%,消费者对流媒体服务需求强劲。欧洲市场在12年后首次恢复了增长。法国、意大利、德国、荷兰和英国这五个欧洲地区最大的市场,收入都有所增长。拉丁美洲市场收入增长1.4%,其数字收入的大幅增长抵消了实体销量的下滑。

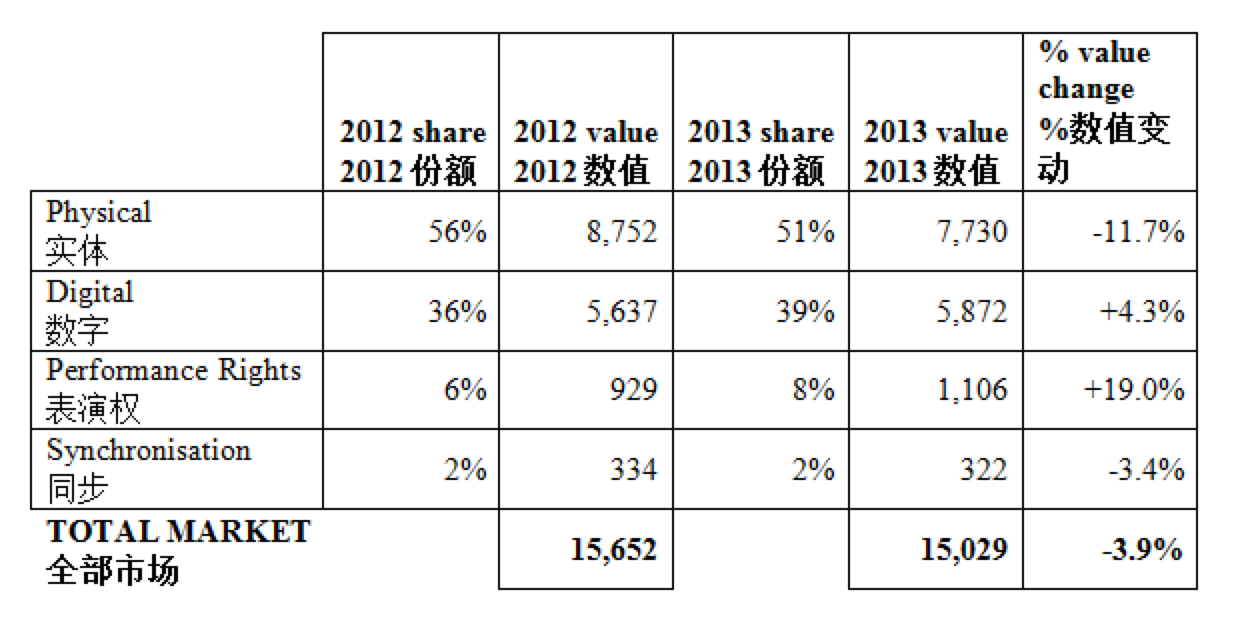

IFPI’s Digital Music Report is published today, showing the global music business offering consumers an ever more diverse range of licensed music services. Revenues from streaming and subscription services leapt 51.3 per cent globally crossing the US$1 billion threshold for the first time.

IFPI数字音乐报告今日发布,展示了全球音乐业务为消费者提供了更多种类的授权音乐服务。订阅收入和流媒体收入大幅增长,增长率高达51.3%,全球总收入首次超过10亿美元。

Despite positive trends in most markets, overall global music trade revenues fell by 3.9 per cent to US$15.0 billion in 2013. The result was heavily influenced by a 16.7 per cent fall in Japan, which accounts for more than a fifth of global revenues. Japan remains a market in transition, with legacy mobile products and physical format sales only now starting to decline, while streaming and subscription services are still establishing themselves.

尽管大多数市场形势喜人,2013年全球音乐贸易收入约为150亿美元,下降了3.9%。这一数据主要受日本影响。日本收入占全球总收入五分之一,其收入锐减了16.7%。 日本市场仍处于转型阶段,其传统移动产品收入和实体格式收入目前正开始下降,而流媒体和订阅服务尚处于建立阶段。

Excluding Japan, the overall global recorded music market was broadly flat, declining in value by 0.1 per cent.

如果剔除日本的影响,全球音乐收入基本与去年持平,下降了0.1%。

Frances Moore, chief executive of IFPI, says: “Even accounting for the difficult situation in Japan, the global recording industry is in a positive phase of its development. Revenues in most major markets have returned to growth. Streaming and subscription services are thriving. Consumers have a wider choice than ever before between different models and services. And digital music is moving into a clearly identifiable new phase as record companies, having licensed services across the world, now start to tap the enormous potential of emerging markets.”

弗朗西丝·摩尔,国际唱片业协会首席执行官说:“即使日本市场正处于艰难时刻,全球唱片业正处于一个乐观的发展阶段。”绝大多数主要市场的收入恢复增长,流媒体和订阅服务蒸蒸日上。可供消费者选择的模式和服务范围比以往任何时候都更广泛。随着唱片公司在全球范围内开展音乐服务授权并开始挖掘新兴市场的巨大潜力,数字音乐正在迈入一个新阶段。

Subscription and streaming surging

订阅收入和流媒体收入不断攀升

The digital market has continued to diversify with revenues from subscription services, such as Deezer and Spotify, growing by 51.3 per cent, passing the US$1 billion mark for the first time. Global revenues from subscription and advertising-supported streams now account for 27 per cent of digital revenues, up from 14 per cent in 2011.

数字市场继续呈现多样化,音乐订阅服务收入(例如:Deezer和Spotify)增长了51.3%,首次超过10亿美元。数字收入中有27%来自于全球订阅收入和受广告支持的流媒体服务收入,远高于2011年的14%。

It is estimated that more than 28 million people worldwide now pay for a music subscription, up from 20 million in 2012 and just eight million in 2010.

2013年全球订阅服务付费用户数约为2800万,2012年这一数字为2000万,而在2010年,订阅服务付费用户数仅有800万。

Music subscription, which has helped transform Sweden and Norway in recent years, is now having similar positive impacts in Denmark and Netherlands.

音乐订阅曾在最近几年帮助挪威和瑞典扭亏为盈,现在在丹麦和荷兰产生了相似的效果。

Record companies continue to license many new services, with Beats Music and iTunes Radio recently launching in the US. The industry hopes and expects these services to spread quickly around the world. There are some 450 licensed services internationally, including global services such as Spotify, which expanded into 38 new markets in 2013, Deezer, Google Play and regional services such as Muve in the US and Asia’s KKBOX.

各个唱片公司在继续为众多新服务授权,例如最近在美国推出的Beats Music和iTunes Radio。行业希望这些服务能迅速在全球范围内推广。目前全球合法音乐服务有450多家,包括全球服务,如Spotify(Spotify在2013年入驻了38个新市场),Deezer和Google Play ,以及一些地区服务,如美国的Muve和亚洲的KKBOX。

Downloads and physical formats remain important

下载和实体格式依然重要

Digital downloads remain a key revenue stream, accounting for a substantial two-thirds of digital revenues (67 per cent). Downloads are helping to drive digital growth in some developing markets, including Hong Kong, the Philippines, Slovakia and South Africa. Revenues from downloads globally fell slightly by 2.1 per cent in value, the decline being offset by increases in streaming and subscription revenue.

数字下载模式仍是一项主要的收入来源,占到了数字收入的三分之二(67%),并推动着香港、菲律宾、斯洛伐克和南非等发展中市场数字收入的增长。全球下载收入略有减少,降幅为2.1%。但这种微降能够被流媒体和订阅收入的增加所抵消。

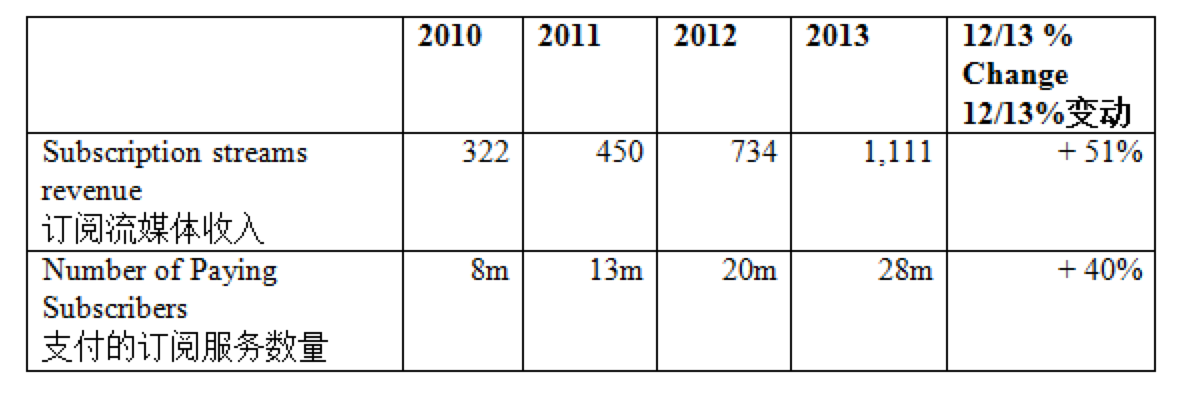

Physical format sales still account for a major proportion of industry revenues in many major markets. They account for more than half (51.4%) of all global revenues, compared to 56 per cent in 2012. Although global physical sales value declined by 11.7 per cent in 2013, major markets including Germany, Italy, UK and US saw a slow-down in the rate of physical decline. France’s physical sales grew by an estimated 0.8 per cent, helped by a local repertoire boom.

实体格式收入在许多主要市场仍然占到了行业收入的大比重。实体格式收入约占全球收入总额的一半(51.4%),2012年时,该数据为56%。虽然2013年全球实体销售收入下降了11.7%,但德国、意大利、英国和美国等主要市场的下降速度趋缓。得益于本地曲目收入的增长,法国实体销售收入增长了约0.8%。

While vinyl sales account for only a small fraction of the overall industry revenues, they have seen an increase in recent years in some key markets. In the US, vinyl sales increased by 32 per cent in 2013 (Nielsen Soundscan), and in the UK, they increased by 101 per cent in 2013 (BPI).

黑胶唱片的销售虽然仅占行业总收入的一小部分,但在一些重要市场,其收入额近年来有所增长。在美国,黑胶唱片收入2013年增长了32%(Nielsen Soundscan);在英国,黑胶唱片收入2013年增长了101%(BPI)

Performance rights and synchronisation income growing

表演权收入和同步使用获得的收入有所增长

Revenue from performance rights – generated from broadcast, internet radio services and venues – saw strong growth. Performance rights income to record companies crossed the US$1 billion threshold for the first time in 2013 to hit US$1.1 billion. This was an increase of 19 per cent, more than double the growth rate in 2012, accounting for 7.4 per cent of total record industry revenue.

表演权收入—即从广播、网络电台以及各类场所获得的收入— 继续保持着强劲的增长。2013年表演权收入首次达到11亿美元,增长了大约19%,增幅为2012年的两倍多,占唱片业总收入的7.4%。增长了大约19%,增幅为2012年的两倍多,占唱片业总收入的7.4%。

Income from synchronisation deals, in which music is placed in advertisements, films or television programmes, declined by 3.4 per cent in 2013, and now accounts for 2.1 per cent of total industry revenue.

将音乐植入广告、电影或电视节目的同步交易的收入在2013年下降了3.4%,占音乐产业总产值的2.1%。

Emerging Markets

新兴市场

A key theme of today’s report is the huge potential of emerging markets following the expansion of licensed digital services in the last three years. Many smaller emerging markets are starting to post significant increases in revenues as digital channels open new opportunities in countries that had a weak physical retail infrastructure. Markets posting significant increases in digital revenue included Argentina (+69%), Peru (+149%), South Africa (+107%) and Venezuela (+85%).

今天的报告的主题之一就是新兴市场的巨大潜力,以及随之而来的授权数字服务在过去三年的发展。在许多原本实体零售设施薄弱的规模较小的新兴市场,得益于数字渠道创造的新机遇,收入开始迅速增长。数字收入迅速增长的市场包括阿根廷(+69%),秘鲁(+149%),南非(+107%)和委内瑞拉(+85%)。

The report also highlights innovative approaches to tap the huge growth potential of emerging markets. Case studies include new pre-paid subscription models bundled with devices in Brazil; the licensing of formerly-unlicensed major internet companies in China; and the opening of new operations in Africa.

本报告还突出了刺激新兴市场巨大发展潜力的创新措施。包括如下几个案例研究:巴西新型的与设备绑定的预付费订阅模式;中国对以前未授权的几大主要互联网公司的授权;以及非洲开展的新业务。

2013 Global Recording Artists Chart, Albums and Singles Charts

2013年全球唱片产业艺人、专辑和单曲排行榜

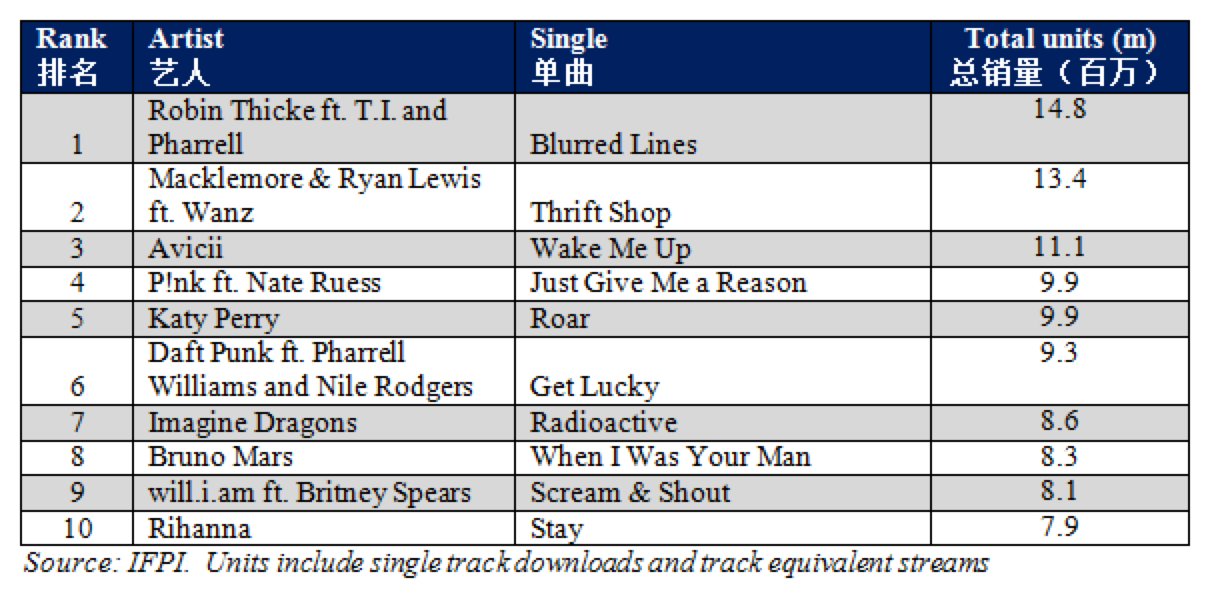

Reflecting the increasing diversity of digital channels, IFPI launched its inaugural Global Recording Artist Chart in January 2014. The chart captured the popularity of artists across multiple licensed channels, including streams on access services such as YouTube and Spotify as well as ownership services such as download stores and physical sales across 2013. It was topped by UK-Irish band One Direction - driven by the global success of their third album Midnight Memories and hit singles Best Song Ever and Story Of My Life.

为展示数字渠道的日益多元化,IFPI在2014年1月发布了首期全球艺人排行榜。排行榜反映了艺人在多个授权渠道的受欢迎程度,包括2013年度YouTube和Spotify等接入服务的流媒体试听,下载网站的下载,以及实体唱片销售。英国-爱尔兰乐队One Direction摘得桂冠,该乐队的成功归功于他们第三张专辑Midnight Memories的全球热卖,以及热门单曲Best Song Ever 和 Story Of My Life.

.png)

One Direction also topped the 2013 global albums chart with Midnight Memories. The album was the fastest selling of 2013 in the UK and sold more than a million copies in its first five weeks of release in the US. It topped the charts in dozens of countries worldwide, from Australia to Sweden.

One Direction的Midnight Memories专辑还位列2013年全球专辑排行榜的首位。该专辑是2013年英国销售最快的一张专辑,在美国发行的五周时间内售出超过100万张。在从澳大利亚到瑞典的全球数十个国家,该专辑销量均居首位。

来源: IFPI

美国-加拿大籍歌手Robin Thicke的单曲位列2013年的单曲排行榜之首,其单曲Blurred Lines在14个国家均取得了第一名的好成绩。该曲目出自其第6张专辑,专辑名为Blurred Lines。

Strong local repertoire sales

强劲的本地专辑销售

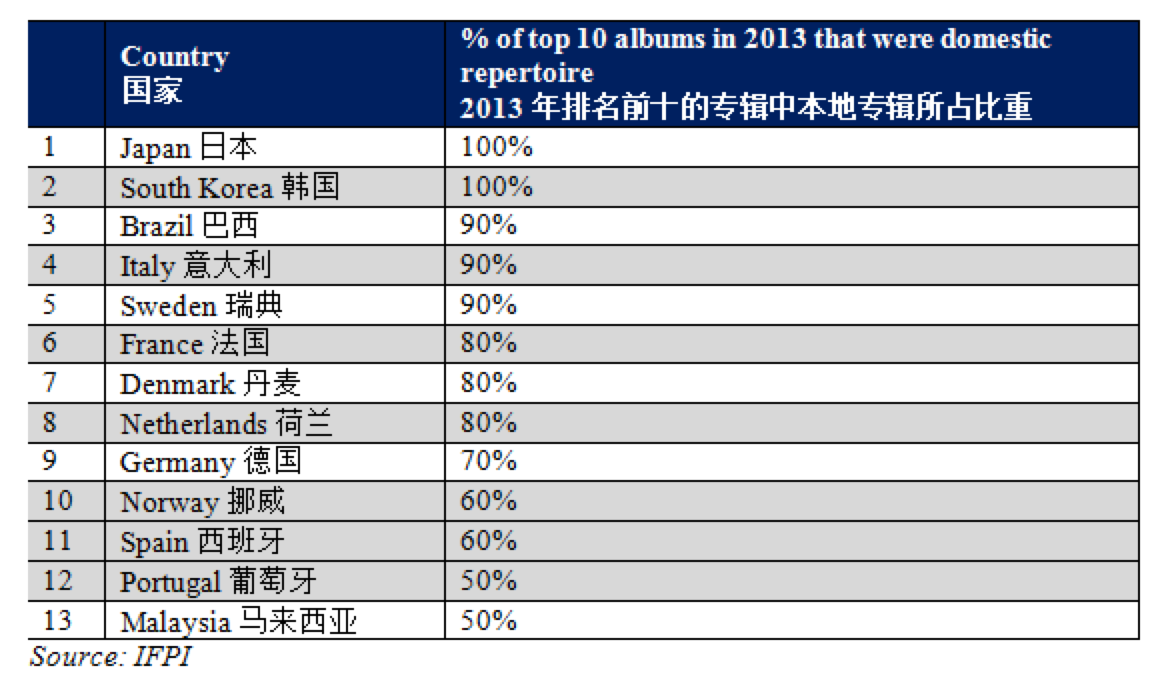

Investment in local repertoire remains the lifeblood of the international music industry. Album charts in individual markets demonstrate the continuing strength of local repertoire as a share of overall music sales. In many markets, local artists account for the vast majority of the top selling albums of 2013. In France, for example, 17 of the top 20 selling albums of 2013 were local repertoire, up from 10 in 2011. In Germany, seven of the top 10 selling albums in 2013 were local repertoire according to GfK figures. Data from 13 non-English language markets confirms the trend.

对本地专辑的投资仍然是国际音乐产业的命脉所在。综观各个市场的畅销专辑榜单,可以看出,作为整体音乐销量的一部分,本地专辑的销量持续增长。在许多国家2013年的畅销专辑榜中,本地艺人的专辑占绝大部分。例如,在法国,排名前20的专辑中,本地艺人的专辑有17张,而在2011年,排名前20的专辑中仅有10张本地艺人的专辑。据GfK统计,德国销量前十的专辑有七张出自本地艺人。来自13个非英语市场的统计数字印证了这一趋势。

Consumers engage with licensed services

消费者参与授权服务

Record companies are licensing a diverse range of services, successfully meeting different consumer preferences. This is illustrated in research undertaken by Ipsos MediaCT covering ten markets in four continents. The research shows that 61 per cent of internet users used a licensed music service in the last six months. It also shows that consumer satisfaction with digital services remains high. Three-quarters of customers (76%) describe them as “excellent” or “very good.”

唱片公司向多元化的服务提供授权,成功地满足了不同消费者的喜好。Ipsos MediaCT所做的覆盖四大洲十个市场的调查结果指出了这一点。该调查结果显示61%的互联网用户在过去的六个月内使用过授权音乐服务。结果还显示消费者对数字服务的客户满意度仍然很高。四分之三(76%)的互联网用户形容数字服务为“优秀”或“非常好”。

Making the internet a better place for digital commerce

为电子商务的发展创造更好的网络环境

The music industry is a business whose success depends on certainty in the legal environment and on copyright law. This is a constant and ever-changing challenge - the music market internationally continues to be distorted by unfair competition from unlicensed services.

音乐产业的成功依赖于法律环境和版权法律的完善。全世界的音乐市场都在受来自未授权服务的不正当竞争的拖累——这个挑战一直存在且不断变化。

IFPI estimates, based on comScore/Nielsen data, that 26 per cent of internet users worldwide regularly access unlicensed services. This estimate applies only to desktop-based devices: it does not include the emerging and as yet unquantified threat of smartphone and tablet-based mobile piracy as consumers migrate to those devices.

I F P I 估计, 根据C o m S c o r e / N i e l s e n 的数据, 全世界26%的网络用户会定期访问盗版网站。由于用户向智能手机和平板电脑等设备转移,此估计仅基于桌面的设备,不包括新兴的、尚无法量化的智能手机和平板电脑设备上的盗版。

Digital piracy is the biggest single threat to the development of the licensed music sector and to investment in artists. It undermines the licensed music business across many forms and channels – unlicensed streaming websites, peer-to-peer (P2P) file-sharing networks, cyberlockers and aggregators, unlicensed streaming and stream ripping and mobile applications.

数字盗版是正版音乐市场发展和投资艺人的最大障碍。它通过多种形式和途径损害着正版音乐市场,这其中包括盗版的流媒体网站、P2P文件共享网络、网络存储空间和聚合器、盗版流媒体和流翻录以及移动应用等。

IFPI’s report highlights five key areas where the recording industry is focusing its fight against piracy:

国际唱片业协会报告指出了音乐产业在与盗版斗争中所关注的五个关键区域:

- Internet service providers (ISPs) have a demonstrable effect on reducing copyright infringement, when required to act. European countries where ISPs are required by courts to block access to infringing sites saw Bit Torrent usage fall by 11 per cent during 2013 (comScore/Nielsen). Countries without the block saw Torrent usage rise by 15 per cent over the same period.

互联网服务提供商(ISP)在对于减少侵权方面,具有显而易见的作用。在实施屏蔽禁令的欧盟国家,2013年期间BitTorrent的使用率下降了11% (comScore/Nielsen). 而在未实施屏蔽禁令的欧盟国家中,同期BitTorrent的使用率上升了15%。

- Search engines remain the largest referrer of traffic to unlicensed services and a recent study by MillwardBrown for MPAA showed that 74 per cent of people using unlicensed services for the first time found them through search engines. Google’s policy to demote results from unlicensed services in results has not been effective. IFPI is pressing the case that search engines have both the technical expertise and a social responsibility to help tackle the problem.

在最近MillwardBrown为美国电影协会所做的一项研究中显示,搜索引擎依然是访问未授权服务的最大渠道,74%的人第一次通过搜索引擎找到并使用未经授权的服务。Google对未授权服务的搜索结果进行降级的措施收效甚微。IFPI正在对这个情况施加压力,因为搜索引擎既有技术专业知识,又有社会责任来协助处理这一问题。

- Litigation has played a key role when required. Recent litigation against isoHunt, Megaupload, Rapidshare and Hotfile has seen those companies either close or put in place measures to reduce the illegal use of their services.

诉讼在必要时起到了关键的作用。最近对iosHunt,Megaupload, Rapidshare和Hotfile的诉讼结果就是这些公司要么关闭,要么采取措施以减少非法使用其服务。

- Legislation is the foundation of the industry’s operating environment. Priorities highlighted include proposed laws to introduce performance rights in markets such as China and Singapore; and the industry’s campaign on copyright reform initiatives in Europe and Australia in order improve online copyright enforcement

立法是行业经营环境的基础。突出的重要事项包括中国和新加坡等国拟通过法律,引入表演权;以及在欧洲和澳大利亚,为了改善网络版权执法,在版权改革举措上进行的行业活动。

- Advertising is a major source of funding for unlicensed music services worldwide: a recent study by the Digital Citizens Alliance suggested that unlicensed services earned US$227 million in 2013 from piracy. A successful project in the UK to tackle the problem led to the City of London Police launching a permanent programme to curb advertising on pirate sites. Voluntary discussions based around codes of conduct are taking place in several other markets.

广告是在世界范围内的未授权音乐服务的主要资金来源:Digital Citizens Alliance最近研究发现,2013年未授权服务从盗版活动中赚取了2.27亿美元。英国的一个项目成功的解决了这个问题,促使伦敦市警察局启动了一个永久的计划来遏制盗版网站上的广告。其他几个市场基于行为准则的自发讨论也在继续。

For further information please contact Adrian Strain or Alex Jacob

Tel. +44 (0)20 7878 7939 / 7940

To order a hard copy of the report, please email laura.childs-young@ifpi.org

进一步信息请联系Adrian Strain 或 Alex Jacob

电话: +44 (0)20 7878 7939 / 7940

订购本报告,请发送邮件至:laura.childs-young@ifpi.org

EDITORS NOTES

编者按

1. World market revenues by format: 2012 & 2013 (US$ million)

世界市场收入:2012 & 2013 (百万美元)

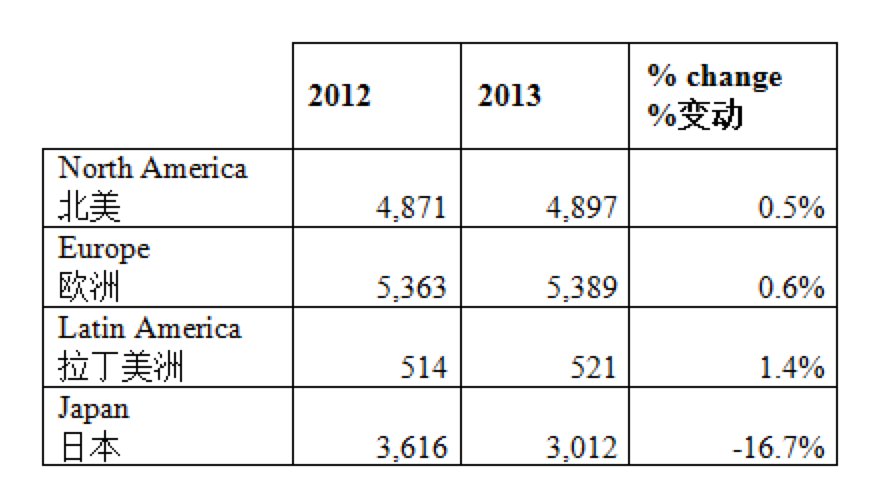

2. Growth in major global markets ($US millions)

主要市场的增长(百万美元)

3. Subscription service growth: Paying Subscribers 2010-2013 ($US millions)

订阅服务增长: 2010-2013年付费订阅用户(百万美元)